Get the free print form 8880 2017

Show details

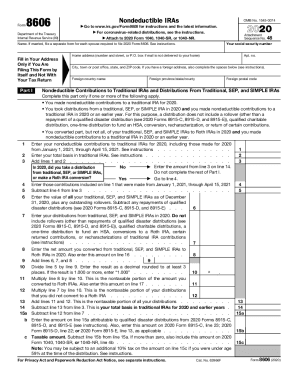

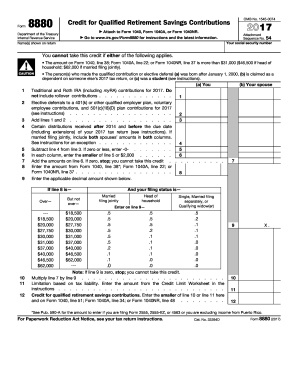

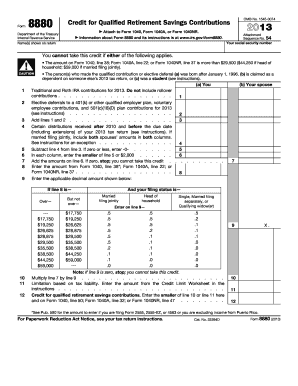

Form8880Attach to Form 1040, Form 1040A, or Form 1040NR. Go to www.irs.gov/Form8880 for instructions and the latest information. Department of the Treasury Internal Revenue ServiceCAUTION2017Attachment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your print form 8880 2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your print form 8880 2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing print form 8880 2017 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form 8880 for 2017. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out print form 8880 2017

How to fill out 2017 form 8880:

01

Gather all necessary information and documents, such as your Social Security Number, adjusted gross income, and contributions made to a retirement savings account during the tax year.

02

Download or obtain a copy of the 2017 form 8880 from the official website of the Internal Revenue Service (IRS).

03

Read the instructions carefully to understand the requirements and eligibility criteria for claiming the Retirement Savings Contributions Credit (Saver's Credit).

04

Begin filling out the form by providing your personal information, including your name, address, and Social Security Number.

05

Enter your filing status and exemptions in the appropriate sections of the form.

06

Determine your adjusted gross income for the tax year and enter it in the relevant field.

07

Calculate your retirement savings contributions credit by referring to the specific instructions provided on the form.

08

Enter the calculated credit amount on the designated line and make sure to double-check for accuracy.

09

Complete any other necessary sections of the form, such as additional credits or payments you may qualify for.

10

Review the completed form for any errors or omissions before submitting it to the IRS along with your tax return.

Who needs 2017 form 8880:

01

Individuals who made contributions to a retirement savings account during the tax year and meet certain income requirements may need to fill out the 2017 form 8880.

02

This form is used to claim the Retirement Savings Contributions Credit (Saver's Credit), which can provide a credit against your taxes owed based on the amount contributed to a qualifying retirement account.

03

It is important to determine if you are eligible for this credit as it can potentially reduce your tax liability and increase your overall tax refund or decrease the amount owed.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8880?

Form 8880 is a tax form used by individuals to claim the Retirement Savings Contributions Credit, also known as the Saver's Credit. This credit is intended to provide an incentive for low- to moderate-income individuals to contribute to retirement savings accounts such as IRAs, 401(k) plans, or similar retirement plans. Form 8880 is used to calculate and claim this non-refundable credit. The credit amount is based on the individual's contributions and income level, allowing them to potentially reduce their overall tax liability.

Who is required to file form 8880?

Individuals who are eligible for the Saver's Credit, also known as the Retirement Savings Contributions Credit, are required to file Form 8880. This credit is intended to help low to moderate-income individuals save for retirement. The eligibility depends on the individual's filing status, adjusted gross income, and the amount of eligible contributions made to qualified retirement savings plans.

How to fill out form 8880?

Form 8880 is used to claim the Retirement Savings Contributions Credit (also known as the Saver's Credit), which provides a tax credit for eligible individuals who make contributions to an eligible retirement plan (such as an IRA or employer-sponsored retirement plan).

Here are the steps to fill out Form 8880:

1. Download the form: You can download the most recent version of Form 8880 from the IRS website or obtain a copy from a local IRS office.

2. Provide personal information: Enter your name, Social Security number, and complete address in the designated boxes at the top of the form.

3. Determine your eligibility: Review the instructions or IRS Publication 590-A to determine if you are eligible for the Saver's Credit based on your income and filing status.

4. Calculate your credit: Use the worksheet provided in the instructions to calculate the amount of your credit. This entails determining your Adjusted Gross Income (AGI), qualifying contributions, and applicable credit rate.

5. Complete Section A: Enter the total amount of contributions made to eligible retirement plans (such as IRAs or employer-sponsored plans) during the tax year.

6. Complete Section B: If you're claiming certain retirement savings contributions as qualifying contributions, provide the necessary information related to these contributions.

7. Complete Section C: Follow the instructions to calculate the credit based on the information entered in previous sections.

8. Transfer the credit: Enter the determined credit amount from Section C onto your Form 1040, Form 1040A, or Form 1040NR in the designated credit line.

9. Sign and date the form: Sign and date the form at the bottom.

Remember to keep a copy of the completed Form 8880 for your records. Also, note that Form 8880 must be filed with your annual tax return. If you are filing electronically, follow your tax software's instructions on attaching Form 8880 to your return.

What is the purpose of form 8880?

The purpose of Form 8880 is to claim the Retirement Savings Contributions Credit, also known as the Saver's Credit. This credit is available to eligible individuals who contribute to an eligible retirement savings plan, such as a 401(k), IRA, or similar account. The credit is designed to provide an incentive for individuals with lower incomes to save for retirement. Form 8880 is used to calculate and claim this credit.

What information must be reported on form 8880?

Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, is used to claim the retirement savings contributions credit. The following information must be reported on this form:

1. Adjusted Gross Income (AGI): This is the total income reported on your tax return minus any deductions or adjustments.

2. Contributions to Retirement Plans: You need to report the total amount you contributed to eligible retirement plans, such as traditional and Roth IRAs, 401(k) plans, and other qualified retirement savings accounts.

3. Credit Percentage: The form includes a table that helps you determine the appropriate credit percentage based on your AGI. You should select the correct percentage based on your filing status and income.

4. Credit Calculation: The form provides specific instructions on how to calculate the credit based on your AGI and eligible retirement contributions. You will need to refer to the table and perform the necessary calculations.

5. Social Security and Medicare Tax: If you received taxable distributions from retirement plans during the tax year, you may need to report the related tax paid by the plan on your behalf.

It's important to review the instructions provided with the form carefully to ensure accurate reporting and calculation of the retirement savings contributions credit.

When is the deadline to file form 8880 in 2023?

The deadline to file Form 8880 for the tax year 2022 was April 18, 2023. As of now, the deadline for filing Form 8880 for the tax year 2023 has not been announced. The Internal Revenue Service (IRS) typically releases the official tax filing deadline for each year in early January or February. So, it is recommended to check the IRS website or consult a tax professional for the most accurate and up-to-date information regarding deadlines.

What is the penalty for the late filing of form 8880?

The penalty for the late filing of form 8880 depends on the individual's tax situation. If an individual fails to file form 8880 and claim the Retirement Savings Contributions Credit (also known as the Saver's Credit) within the required time limits, they generally cannot claim the credit for that tax year. However, if the individual is due a refund, there is generally no penalty for filing a late form 8880 since there is no tax liability owed. It is important to note that individual circumstances may vary, and it is advisable to consult a tax professional or the Internal Revenue Service (IRS) for specific guidance.

How can I modify print form 8880 2017 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your irs form 8880 for 2017 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the 2017 form 8880 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form 8880 2017 in seconds.

Can I edit form 8880 for 2017 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 8880 form 2017 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your print form 8880 2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2017 Form 8880 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.